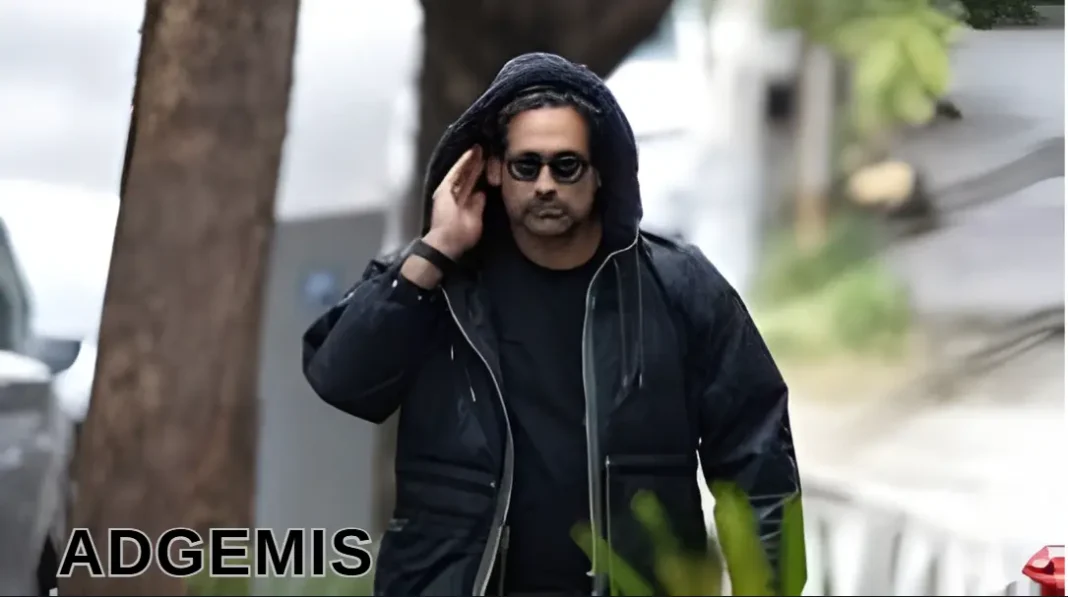

Jon Adgemis, who was a young and promising hospitality figure in Sydney, has turned into a lesson of too much debt and broken dreams. The disgraceful fall of the former KPMG partner has cost the creditors a whopping 1.8 billion dollars and completely altered the landscape of the Australian pub industry. His experience acts as a painful lesson concerning the dangers of fast growth that is financed by expensive personal credit.

Who is Jon Adgemis?

Jon Adgemis is a 47-year-old Greek-Australian entrepreneur who turned into a highly regarded corporate financier only to become one of the most infamous business failures in Australia. Adgemis was born to grandparents of Greek immigrants and graduated with a degree in economics, and joined KPMG in 1999 in the Mergers and Acquisitions department. His early life career had been characterised by major deals such as the merger of BHP-Billiton and other deals with big companies such as the Westfarmers.

Having established his name in KPMG and a brief stay in Gresham Partners, Adgemis came back to KPMG as a partner, where he cultivated his network and financial skills that would later be used to power up his hospitality interests. He started to switch out of corporate finance to distressed hospitality assets when he saw the chances in the pub ownership business at the time of the COVID-19 pandemic.

The Empire of Public Hospitality Group.

Building the Portfolio

Adgemis started Public Hospitality Group (PHG) in the middle of the pandemic and set out on a frenzy of acquisitions, buying more than 20 pubs and hotels in Sydney and Melbourne. His plan was to acquire non-performers and transform them into boutique hotels and high-end food and drink services to appeal to the wealthy customers.

Some of the important venues he had in his portfolio were:

- Oxford House in Paddington

- The Norfolk in Redfern

- Camelia Grove Hotel Alexandria.

- The Strand Hotel at Darlinghurst.

- The Hotel Exchange in Balmain.

- Empire Hotel in Annandale

- Hotel Diplomat in Potts Point.

- South Bondi Hotel (previously Noah’s Backpacker)

The Unsuccessful Funding Model.

Adgemis used private credit markets to finance its expansion, mostly by exploiting cheap debt during the pandemic. He took loans based on the estimated value of finished renovations instead of the prevailing asset values, a decision that was disastrous with the increase in interest rates. As of 2023, PHG had at least half a billion dollars of debt on its books relative to its assets acquired at under 300 million dollars, with 95 million dollars already paid in interest alone.

The Greek tradition and Family ties.

Jon Adgemis is a grandson of Greek migrants who have had close ties with the Greek community in Australia. His grandmother, Helen Confos, became the oldest Greek Australian in the country when she passed away in July 2021, aged 109. This relationship with the Greek community proved to be unhealthy after the break-up of his association with the Hellenic Club of Sydney, and they owed the club a wedding deposit amounting to 1.6 million.

His mother, Rose Adgemis, owned a property with Jon in Rose Bay, which was later repossessed by the financiers during the debt recovery process. The family’s financial dealings were also an issue of dispute when it turned out that Adgemis had mortgaged the property of his mother against her own will.

The Extravagant Living That Came under Fire.

Adgemis was also credited with a lavish lifestyle when his business empire was crumbling. His possessions included:

- A 95-foot luxury yacht, previously owned by movie star Shirley Temple, called “Hiilani,” was eventually seized and sold by the Commonwealth Bank.

- A Range Rover priced at $230,000 and a Mercedes-Benz G63 AMG priced at $240,000 in the years 2022 and 202,1, respectively.

- Living in an apartment in Bondi Beach, which had a price of $000 every month, and he was being sponsored by a friend.

His lavish spending resulted in him owing creditors billions of dollars, which made his way of life unsuitable for someone in his financial status, and he was criticised by the Australian Taxation Office and the regulators of bankruptcy.

The $1.8 Billion Collapse

The Debt Structure

The total debts of Adgemis amounted to about 1.8 billion dollars, and its bankruptcy was the highest in Australian history, alongside Alan Bond’s in 1992. The debt structure included:

- Debt to Deutsche Bank amounted to 371 million.

- In excess of 438.4 million to the Sydney-based private credit company Gemi Investments.

- 162 million to the Australian taxation office.

- Hundreds of millions of others to different private credit institutions.

The Unraveling

In 2024, the situation worsened as interest rates increased and the company was no longer able to service its debts and operate. Although he received a rescue package amounting to 400m led by Deutsche Bank in mid-2024, the rescue was only a temporary solution. In September of 2024, five pubs were acquired by New York-based lender Muzinich & Co., which asserted debts of $126 million.

On October 3, 2025, Adgemis declared personal bankruptcy, stating only $3.79 in his bank account. Andrew Yeo of Pitcher Partners was made the bankruptcy trustee.

Effects on Creditors and Employees.

Many stakeholders have been hit by the collapse:

- There are about 800 ex-workers who are owed money.

- Unpaid staff entitlements of 6.7 million are unpaid.

- Contractors and small businesses lose a lot of money.

- The wider Australian society in terms of unpaid taxation.

According to the Australian Financial Security Authority, the personal insolvency agreement proposed by Adgemis would have paid only 0.15 cents in the dollar to the creditors, which is far less than the average payout in a bankruptcy.

Status and Assets Sales.

Other secured creditors of the Deutsche Bank have launched sale campaigns on the remaining assets following the bankruptcy declaration. Management of the three major venues of The Norfolk, Oxford House, and Camelia Grove Hotel has been assumed by Solotel Group, which is an industry veteran managed by Bruce Solomon.

The five remaining venues have been selected as the receiver of McGrathNico, and there were plans to finish the current construction projects before the sale. The Empire Hotel and Hotel Diplomat are also in operation, and they are looking to find buyers.

Australia Hospitality Industry lessons.

The Adgemis collapse has exposed serious problems in the Australian private credit sector, as well as the hospitality financing. His narrative shows the risks of:

- Over-leveraging on projected and not current asset values.

- High reliance on such expensive private credit to grow.

- Keeping up with high personal expenses in hard business times.

- Evident growth that lacks capital reserves.

The case has led to increased attention being paid to the scrutiny of the private credit arrangements and personal insolvency proposals.